The Threat of Synthetic Identity Fraud

Synthetic identity fraud is one of the fastest-growing financial crimes, combining real and fake personal data to create entirely new identities that slip past traditional checks. Unlike ordinary identity theft, these “Frankenstein identities” can build credit and trust over time before fraudsters vanish with major financial gains. This blog breaks down how synthetic identity fraud works, why it’s so dangerous for businesses and individuals, and what can be done to detect and prevent it.

Synthetic Identity Fraud: Definition and Explanation

Synthetic identity fraud occurs when criminals blend fake and real information found through data breaches, such as Social Security Numbers (SSNs) and names to fabricate a new identity. This false identity is then used to defraud financial institutions, government agencies, or individuals by opening fraudulent accounts and making illegitimate purchases.

This type of fraud is particularly prevalent in the US due to the heavy reliance on personally identifiable information (PII) like SSNs for identity verification.

Detecting synthetic identity fraud is more challenging than traditional identity theft because victims often include individuals who rarely check their credit information, such as children, the elderly, or the homeless. Fraudsters typically develop these synthetic identities over time, steadily applying for credit and building a positive payment history before eventually maxing out the credit and disappearing. This prolonged nurturing of fake identities allows them to commit financial fraud while remaining unnoticed for extended periods.

The Mechanics of Synthetic Identity Theft

Synthetic identity theft works by combining real and fabricated identity details to create accounts or make purchases fraudulently. The genuine information, often stolen (e.g., photos, SSNs, date of birth), is mixed with fake details like fictitious names, addresses and more. Fraudsters then use this synthetic identity to open credit cards or make fraudulent transactions, earning the nickname „Frankenstein identity” for the way it pieces together various bits of information.

Initially, a fraudster might use the synthetic identity to open accounts or perform actions that build up credit and credibility. Once they appear to be highly qualified, low-risk borrowers, they make large fraudulent purchases or take out substantial loans before disappearing. The potential for large financial gains and the ability to evade detection make synthetic identity fraud appealing to criminals and crime rings. It represents a sophisticated level of fraud executed by highly skilled identity thieves.

Synthetic identities are tough for basic fraud detection systems to identify because they incorporate elements of real identity. Businesses must employ identity proofing services with robust, multi-layered fraud detection capabilities to identify synthetic identity theft. As digital transactions and online activities increase, so does the incidence of online fraud across various sectors, including traditional banking and cryptocurrency.

How Does Synthetic Identity Fraud Happen?

Fraudsters collect stolen data, such as SSNs, birthdates, or photos, from breaches, leaks, or the dark web. They then combine these with false details to create a believable, but fake, identity. Once established, the fraudster uses this identity to open bank accounts, secure loans, or commit other financial crimes.

Over time, the synthetic identity builds a positive credit history, which makes it harder to spot. By the time the fraudster “busts out” (maxing out loans or cards and disappearing), the damage is already done.

Manipulated Identities

Fraudsters may take an existing person’s identity and tweak it — for example, slightly changing an address or date of birth to mask a poor credit history. These are often easier to detect.

Manufactured Identities

The more sophisticated form involves blending real and fake data to create a completely new identity. For example, using a real SSN with a fake name, fabricated address, and invented phone number. This “person” doesn’t exist but can still fool many systems.

What is a Synthetic Identity Used For?

Synthetic identities can serve many criminal purposes. Once established, they become powerful tools for fraudsters to exploit financial systems and beyond.

Credit Card Fraud

One of the most widespread uses of synthetic identities is to apply for credit cards or personal loans. Fraudsters often nurture these accounts responsibly at first by making small purchases and paying them off to establish credibility. Once trust is built, they “bust out,” maxing out credit cards or defaulting on loans before disappearing. Because the identity doesn’t belong to a real person, there is no one to pursue for repayment, leaving financial institutions with unrecoverable losses.

Money Laundering

Synthetic identities are also a convenient tool for laundering illicit funds. Fraudsters open multiple accounts under different synthetic profiles, moving money back and forth to obscure its origins. By layering transactions through accounts that appear legitimate on paper, criminals can integrate illegal profits into the financial system without attracting suspicion, making it harder for regulators and investigators to trace.

Government Benefit Fraud

Government programs, such as unemployment benefits, social security, or stimulus relief funds, are common targets for synthetic identity schemes. By using fabricated identities, fraudsters can file multiple fraudulent claims, siphoning money intended for vulnerable populations. The large scale and high volume of such programs make them especially vulnerable, often resulting in billions of dollars in taxpayer losses.

Healthcare Fraud

In the healthcare sector, synthetic identities may be used to obtain medical services, expensive treatments, or prescription drugs. This can range from fraudsters seeking free care to criminal groups acquiring controlled substances for resale. Beyond financial costs, synthetic healthcare fraud risks creating corrupted medical records tied to non-existent patients, which can cause confusion or even harm when linked to real individuals.

Cryptocurrency Scams

With the rapid growth of digital assets, synthetic identities are increasingly used to onboard fraudulent users to crypto exchanges and wallets. Criminals exploit weak or absent identity verification processes to trade, move, and launder money anonymously. In some cases, synthetic accounts are used for pump-and-dump schemes or to bypass regulatory restrictions. The relatively unregulated nature of cryptocurrency platforms makes them especially attractive for fraudsters leveraging synthetic IDs.

Types of Synthetic ID Theft

- Financial Fraud: Credit cards, loans, and mortgages.

- Employment Fraud: Using synthetic IDs to pass background checks.

- Immigration Fraud: Exploiting systems to gain entry or work permits.

- Criminal Shielding: Committing crimes under a false identity to avoid detection.

The Dangers of Synthetic Identity Fraud

Synthetic fraud is more than a financial issue — it erodes trust in institutions, drives regulatory scrutiny, and inflicts emotional harm on victims. Its slow, hidden nature means it often goes undetected until the damage is irreversible.

The Impact of Synthetic Identity Fraud

Impact on Businesses

Billions lost annually in unpaid debts

Synthetic identity fraud drains enormous sums from financial institutions each year. When a fraudster uses a fabricated identity to secure loans or credit cards, the eventual defaults translate into losses that cannot be recovered. Since no real individual exists behind the debt, collection efforts are impossible, leaving businesses with write-offs that directly impact profitability.

Strain on fraud detection resources and compliance obligations

Businesses are forced to continually invest in more sophisticated fraud detection tools, compliance programs, and security infrastructure. While necessary, these measures are costly and resource-intensive, stretching compliance teams thin and diverting funds from innovation and customer service. Smaller institutions, in particular, may struggle to keep up with evolving regulatory expectations.

Damage to brand trust when customers feel unprotected

When synthetic fraud occurs, customers may question whether a business can truly safeguard their sensitive data. Even if a customer is not directly affected, high-profile fraud cases erode overall confidence in the company. Once trust is compromised, businesses may face customer attrition and reputational damage that lingers long after financial losses have been absorbed.

Risk of regulatory penalties for inadequate fraud prevention

Governments worldwide are tightening expectations around identity verification and financial crime prevention. If businesses fail to implement adequate controls and are found to be negligent in preventing fraud, they risk heavy fines, sanctions, or legal action. Beyond financial penalties, regulatory scrutiny can harm relationships with partners and investors.

Impact on Individuals

Credit destroyed, often without the victim’s knowledge

Victims of synthetic identity fraud frequently discover the issue only when they apply for a loan, mortgage, or credit card. By then, their credit history may already be riddled with unpaid debts, making financial recovery slow and frustrating.

Children, elderly, and homeless individuals disproportionately affected

These vulnerable groups are prime targets because their personal information is less likely to be monitored. A child’s Social Security Number, for example, can be exploited for years before anyone notices. For the elderly or homeless, the lack of regular financial activity means fraudulent use often goes undetected.

Denied loans, mortgages, or job opportunities due to false credit records

Even when victims manage to prove fraud, the process can take months or years to resolve. In the meantime, incorrect credit data may prevent them from securing essential financial products, renting housing, or passing background checks for employment.Years of effort required to repair identity and restore reputation

Unlike a stolen credit card number that can be quickly replaced, synthetic identity fraud can linger for years in databases and credit reports. Victims must work with multiple institutions — banks, credit bureaus, regulators — to unravel the false records. The emotional toll, from stress and frustration to the fear of recurring fraud, often matches the financial damage.

How to Detect Synthetic Identity Fraud

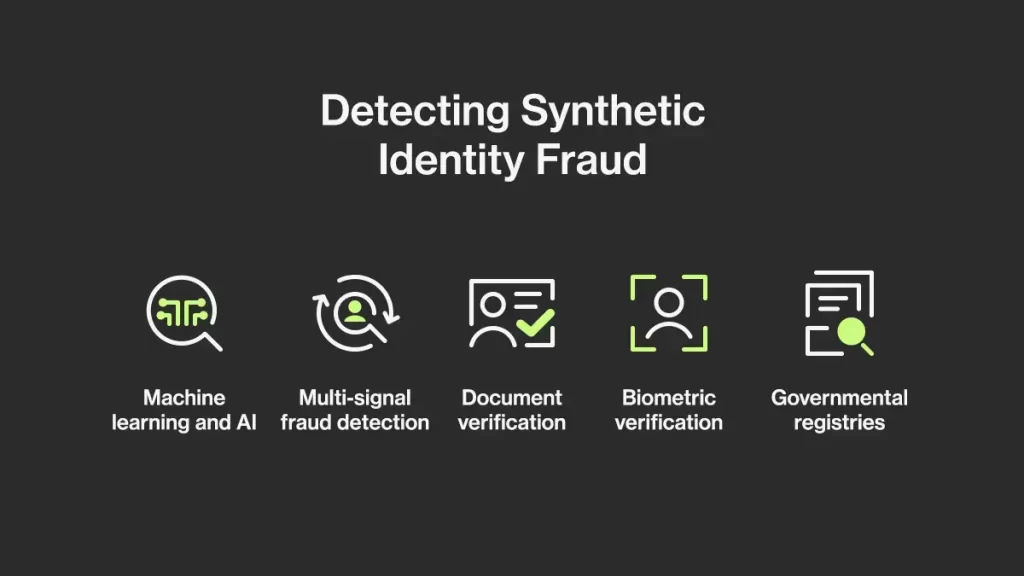

Detecting synthetic identity fraud requires multiple approaches. One fundamental method is leveraging machine learning (ML) and artificial intelligence (AI) to analyse customer behaviour patterns and identify anomalies. Additionally, businesses can cross-reference various data sources, including third-party data, across accounts, portfolios, and organisations to uncover inconsistencies.

Investing in advanced identity verification methods, such as document and biometric verification powered by AI algorithms, is crucial. While synthetic identities that combine real SSNs with fake data can often pass credit bureau checks, they are less likely to survive thorough document verification. Fraudsters typically cannot produce genuine identity documents that match their synthetic identities.

Incorporating government-verified data is also essential. For example, the US government’s eCBSV (Electronic Consent Based Social Security Number Verification) service helps combat synthetic identity fraud by matching names, birthdates, and Social Security Numbers, and providing death indicators.

Avoiding synthetic identity fraud requires businesses to adopt sophisticated identity verification methods. Here are some effective strategies:

Machine learning and AI: Utilise these technologies to understand customer behaviour patterns and spot anomalies.

Multi-signal fraud detection: Analyse and connect various data points across accounts and organisations.

Document verification: Require fraudsters to submit identity documents, making it harder for synthetic identities to pass checks.

Biometric verification: Use biometric data, such as facial recognition or fingerprints, to verify identities.

Governmental registries: Leverage government validation services like eCBSV to match identity attributes and detect fraud.

How to Prevent Synthetic Identity Fraud

Avoiding synthetic identity theft requires proactive measures and the right technology. Traditional manual verification processes are no longer sufficient as they are slow, resource-intensive, and prone to human error. To stay ahead of increasingly sophisticated fraudsters, businesses must adopt automated, multi-layered defenses that strengthen every step of the customer journey.

Automated ID verification stands out as the most effective method to reduce identity fraud and catch fraudsters. Automated solutions like Ondato’s service streamline the verification process, enabling rapid client onboarding while simultaneously detecting sophisticated spoofing attempts, such as the use of masks or document alterations.

By integrating Ondato’s automated biometric identification tool, organisations can delegate the heavy lifting to a smart and reliable system. This not only saves time and enhances performance but also ensures a higher level of safety and accuracy in fraud detection. The use of advanced technology in automated ID verification helps in maintaining compliance with financial regulations and protects businesses and their customers from the detrimental impacts of synthetic identity fraud.

Last Thoughts

Synthetic identity fraud is a significant and growing threat. Businesses must move beyond traditional verification methods and adopt more advanced techniques to protect against this sophisticated type of fraud. By implementing robust, multi-layered fraud prevention strategies, businesses can better safeguard their operations and their customers’ identities.